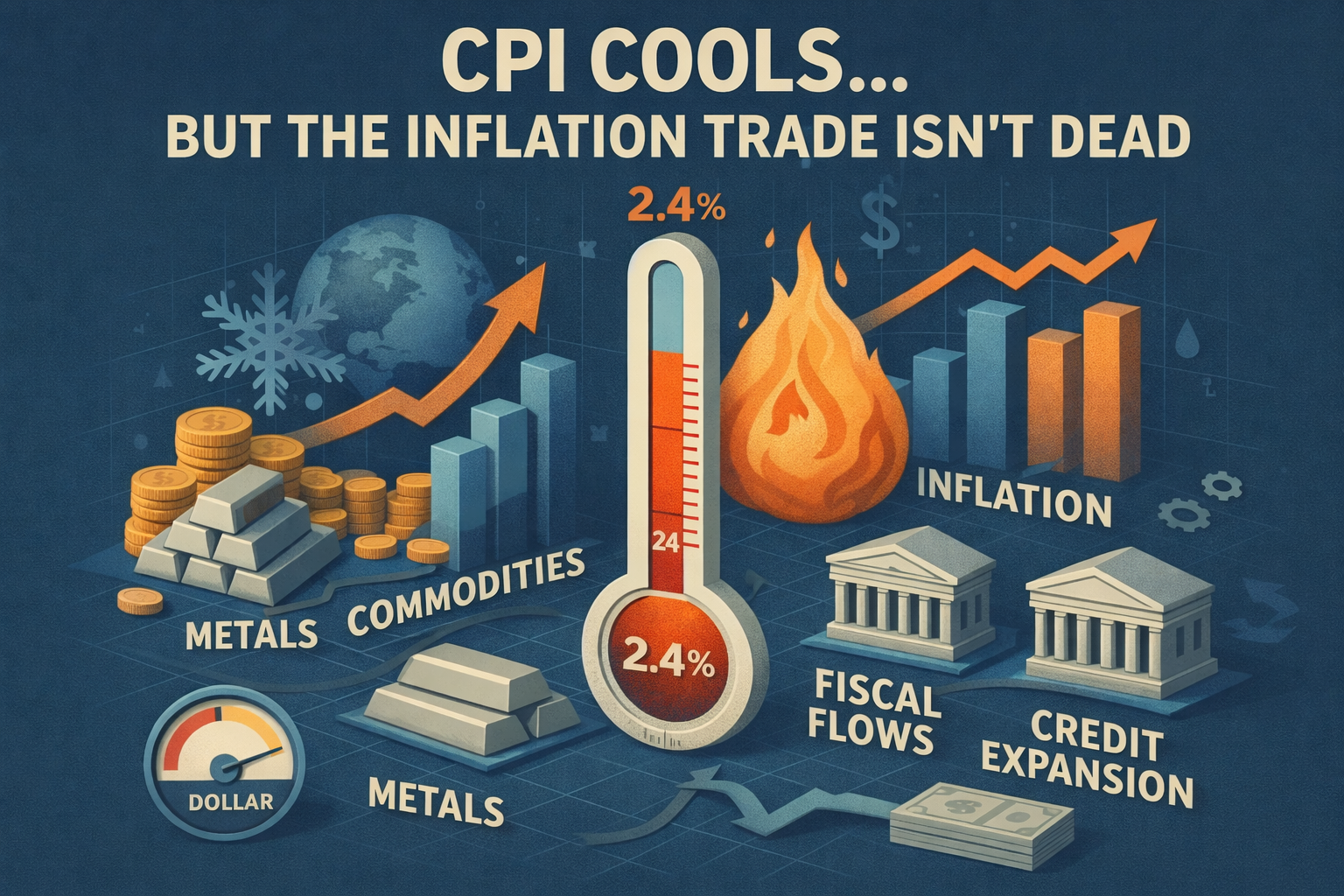

On Friday, we got the January CPI report. Headline year-over-year inflation came in at 2.4%, below the consensus expectation of 2.5%. On the surface, that looks like another step in the “inflation is cooling” narrative that has dominated over the past year.

But I want to explain why I don’t think this print changes the bigger picture—and why, from a business cycle and MMT perspective, we may actually be getting close to the point where inflation starts to reaccelerate.

More importantly, I want to walk through what this means for portfolios and asset positioning. Because if you wait for CPI to clearly turn higher before positioning for inflation, you’re probably already too late.

The Market Isn’t Fully Buying the “Cooling Inflation” Story

Here’s something interesting: even as CPI has cooled over the last year, assets that typically outperform in inflationary environments have been winning.

Think about what’s been working: