On Fascism with Jon Weier

— Publication: Perspectives Journal —Listen to the full conversation on the Perspectives Journal podcast, available to subscribe on Spotify, Apple Podcasts, YouTube, and all other major podcast platforms.

In September 2025 the Broadbent Institute joined left–wing think tanks from Chile, Brazil, Colombia, Mexico, Uruguay and Spain to support the establishment of a global network of think tanks that produce rigorous analysis, foster data-driven debate, and contribute to the search for proposals in defense of democracy.

This shocking deal is a gross betrayal of millions of voters

— Organisation: The Australia Institute —I’ve been lucky enough to complete a few multi-day hikes overseas in the past few years. Every morning, I woke up in my tent with the feeling that something wasn’t quite right and then I realised why – it was practically silent.

There’s no cackle of kookaburras at dawn, no warble of magpies, or comforting screeches of cockatoos. Songbirds the world over had their evolutionary origins right here in Australia, but we’ve got the original and the best (and the loudest).

As a giant island, Australia is a hotspot for biodiversity. We are home to countless plant and animal species found nowhere else on Earth, thanks to millions of years of evolution in isolation.

Overall, Australia’s nature laws have done a crap job of protecting them. Unfortunately, Environment Minister Murray Watt looks set to continue that track record, with news he’ll be negotiating to pass an overhaul of Australia’s nature laws with the Coalition, not the Greens. That pretty much tells you everything you need to know.

Gas exporters pay no tax (again) | Between the Lines

— Organisation: The Australia Institute —The Wrap with Hayden Starr

For the last five years I’ve worked behind the scenes, helping communicate the Australia Institute’s research online and on social media, including writing and editing this newsletter. As my time with the Australia Institute comes to an end, it’s my pleasure to write The Wrap for my last newsletter with you.

It takes a lot to change someone’s mind. It takes a lot to change a country. Even more so when you are up against the very well-resourced and very powerful misinformation machines that serve to defend and consolidate power, wealth, and the status quo.

There are few better examples than that of the fossil fuel industry. Greenwashing gas, overinflating economic benefits, spreading lies about renewable energy, all while digging new coal mines and gas wells and paying a pittance (or nothing) in tax.

“Australia is one of the biggest gas exporters in the world.

“Yet when gas prices go up, it’s Australians that feel poor.”

The American Mind Podcast: The Roundtable Episode 288

— Organisation: The Claremont Institute —The American Mind’s ‘Editorial Roundtable’ podcast is a weekly conversation with Ryan Williams, Spencer Klavan, and Mike Sabo devoted to uncovering the ideas and principles that drive American political life. Stream here or download from your favorite podcast host.

Nobelesse Oblige | The Roundtable Ep. 288

A closer look at the ANU books reveals a hard truth about these job cuts

— Organisation: The Australia Institute —These claims have been dutifully repeated, but a close look at the university’s audited accounts tells a very different story.

To be clear, the numbers signed off by their auditor state that in 2024 ANU recorded a $90 million surplus and increased the value of its net assets.

So, how do you turn a $90 million surplus into a $142.5 million deficit?

Easy. You just exclude nearly a quarter of a billion dollars of revenue that the auditor thought should be included.

By excluding $232.4 million of revenue recognised by the independent auditor, the ANU was able to transform its healthy surplus in 2024 into a “underlying operating deficit.”

Sounds scary, right?

The auditors ticked off on one set of numbers, and the senior leadership waved another set at their staff, students and community in order to justify the spending cuts they want to make.

To be clear, according to the ANU’s audited financial results, it had $3.8 billion in net assets at the end of 2024, compared to $3.7 billion at the end of 2023.

No Honor Among Assassins

— Organisation: The Claremont Institute —The assassination of Charlie Kirk was not just evil, it was cowardly—and above all, dishonorable.

That an action might be dishonorable used to bother men, dissuading them from perpetrating such an act. When Themistocles was on the run from both the Spartan authorities and his own Athenian countrymen, he fled to the royal court of Molossia. Though Themistocles and King Admetus were mortal enemies, he supplicated his host. Themistocles said that if the king wished to take vengeance on him, honor demanded he should pick another time, when the two were on equal footing. With thoughts of honor swirling in his mind, the Molossian king protected his guest from his pursuers.

Honor codes are the most powerful restraint—much more powerful than state law—on those who are able and willing to use violent force. No wonder we see honor so highly prized among warrior castes and the political classes of healthy nations—knights, Spartiates, the admiralty, military aristocracies, and so on. A sense of honor not only curbs chaotic violence among the energetic, but it also channels that aggression toward productive ends, even toward excellence.

However, left-wing activists have spent at least the last generation demolishing the edifice of honor in the hearts of young men. We are now reaping the whirlwind.

Losing the Telos

End‑of‑Month Activity Across the Treasury Market

— Organisation: Federal Reserve Bank of New York — Publication: Liberty Street Economics —Substack Recommends Nazis

— —Foreword: Stained Glass Woman remains on Substack because I, frankly, can’t afford any of the competing options that have even passable security. Because this newsletter is and will always be free and because of its size and traffic, functional hosting alternatives would cost into four digits.

Building Canada’s Trades Future with Lee Caprio

— Publication: Perspectives Journal —‘Making the Good Society’ is a video series from the Broadbent Institute and Perspectives Journal that asks progressive leaders and thinkers about their vision for a good society that is humane, just, and democratic.

In this episode, Lee Caprio of the International Brotherhood of Electrical Workers (IBEW) Local 353 explains how unions build sustainable careers—not just jobs—for thousands of workers. IBEW’s “learn as you earn” apprenticeship model ensures safety and skills training, while initiatives like the Pathways and Hammer Heads programs open doors for more women, Indigenous, racialized and newcomer workers to enter the trades.

Housing affordability to get worse as big corporates do annual tax magic

— Organisation: The Australia Institute —On this episode of Dollars & Sense, Greg and Elinor discuss housing affordability, how so many of Australia’s biggest companies manage to pay zero (0) corporate tax, and how Trump made solving the tax problem that much harder.

Use the code ‘podcast’ to get 50% off tickets to the Australia Institute’s Revenue Summit. Discount available for Dollars & Sense listeners while stocks last.

Dead Centre: How political pragmatism is killing us by Richard Denniss is available now via the Australia Institute website.

This discussion was recorded on Thursday 9 October 2025.

Host: Greg Jericho, Chief Economist, the Australia Institute // @grogsgamut

Host: Elinor Johnston-Leek, Senior Content Producer, the Australia Institute // @elinorjohnstonleek

Show notes:

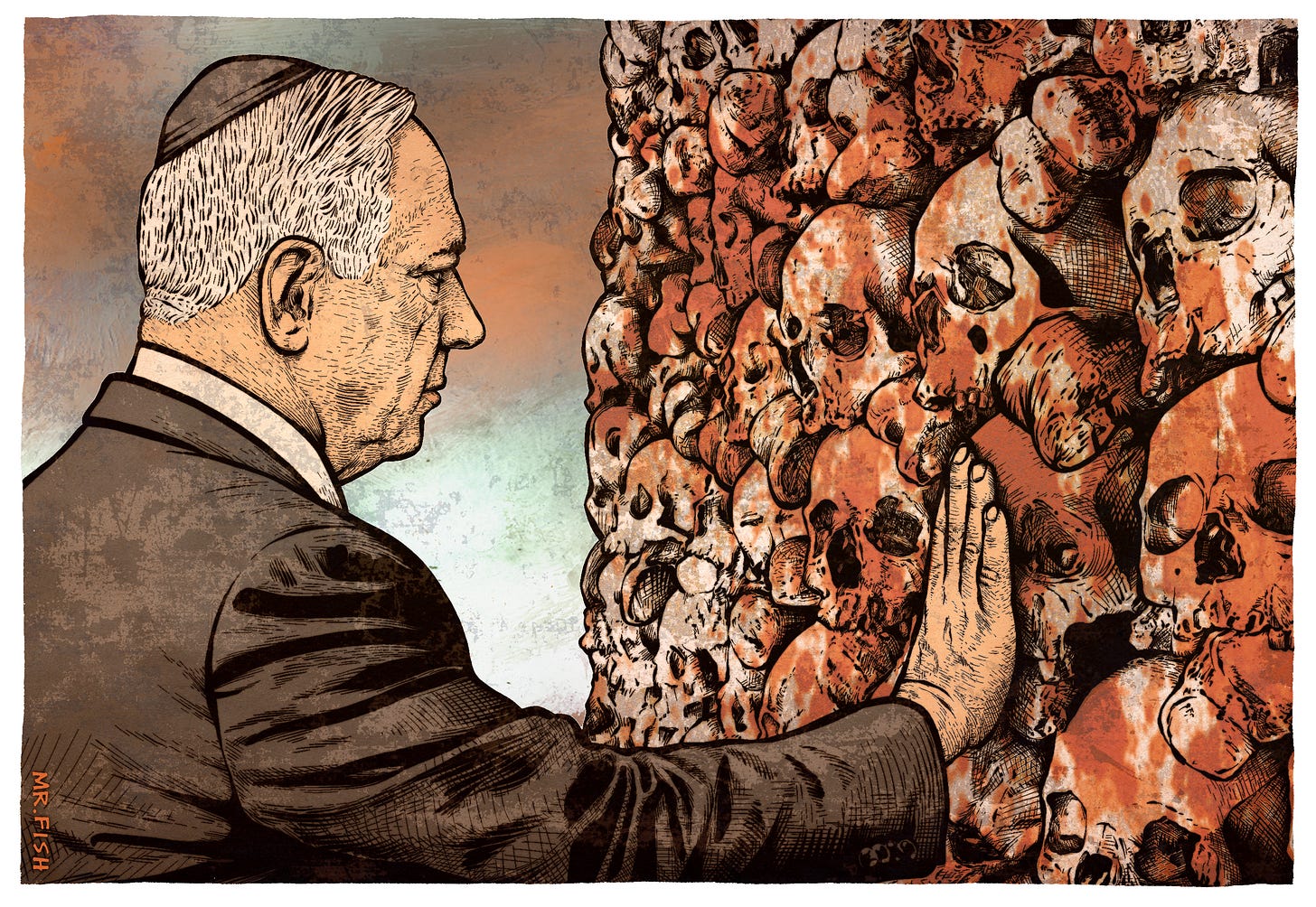

Inside America's Academic Gulags (w/ Rashid Khalidi) | The Chris Hedges Report

— —This interview is also available on podcast platforms and Rumble.

Historian Rashid Khalidi, author of The Hundred Years’ War on Palestine, joins host Chris Hedges to detail the dwindling academic freedom in American universities and society at large as Donald Trump’s grip on free speech tightens.

Khalidi notes that while the conflation of anti-Zionism with antisemitism is an old tactic to stifle academic scrutiny of Israel, its current deployment is unprecedented. Today, professors are intimidated out of teaching about Israel and Palestine, entire Middle Eastern studies departments are threatened with receivership and federal funding is withheld from universities.

From Clan to Congress: Why Ilhan Omar Betrays the Meaning of Citizenship

— Organisation: The Claremont Institute —Loyalty can elevate or enslave. Placed in truth, it anchors. Placed in tribe, it distorts. Though I have known both, I abandoned the latter and embraced the former. That is why when I look at Ilhan Omar and Charlie Kirk, I see two distinct moral universes.

Charlie’s foundation was faith in Christ and country, in family and the free market. His faith was that America embodies true freedom and dignity because our country was founded on biblical principles—principles that demand that power be checked and the weak be protected.

Ilhan Omar’s foundation rests on three pillars: clan, Islamism, and leftism. Each demands loyalty not to principle but to faction. Each reduces life to a struggle for dominance.

I know Omar’s world. It is a place without law, where men with swords and guns decide the fate of neighbors, where girls are cut to mark them as pure, where bribes stand in for justice. These are not random misfortunes, but the dynamics of the system Omar embodies. It incentivizes and rewards absolute and unchecked power—even at the expense of life, limb, and property.

Cutting Back the Administrative State

— Organisation: The Claremont Institute —The Trump Administration’s approach to the government shutdown is aimed above all at recovering the unitary executive as envisioned by the framers of the Constitution. Article II’s vesting clause, the epitome of “short and sweet,” empowers the president to control the executive branch, as Alexander Hamilton explained in Federalist 70. Though the administrative state steadily seized the chief executive’s power throughout the 20th century, President Trump seems determined to wrest it back by reasserting his authority over the executive agencies under his purview.

In preparing for the shutdown, each agency created contingency plans for operating during a lapse in appropriations. These are required by law and managed under guidance from the Office of Management and Budget (OMB) to ensure that essential government functions continue even when Congress fails to pass funding.

Each shutdown plan outlines an agency’s core mission, identifies which functions are critical, and lists how many employees will keep working and how many will be furloughed. It also explains how the agency will communicate with staff, why certain programs are allowed to continue, and how operations will restart once funding is restored.

Just Answering Questions: The Fall

— —Update at 7:30 CST: There are now over 50 questions, so I’ve got to shut comments down to keep the Q & A at a reasonable length. Themes addressed by multiple people will get top priority. I hope to have the new article up by the end of the week. Thank you very much everyone!

***

Hello subscribers (and future subscribers!) It’s time for a Q & A. For those new to this feature, here’s how it works:

1) To ask a question, join as a paying subscriber, and post your question in the comments section below:

2) I will answer as many questions as I can in a separate article. Sometimes I bundle questions to address common themes. Please keep questions brief and ask only one!

The Rise of Sponsored Service for Clearing Repo

— Organisation: Federal Reserve Bank of New York — Publication: Liberty Street Economics —Australia is a rich country that taxes like a poor one

— Organisation: The Australia Institute —On this episode of Follow the Money, Matt Grudnoff and Ebony Bennett discuss the latest data from the Australian Taxation Office showing that 30 per cent of large corporations paid no company tax in 2023-24 – with the gas, coal, salmon and tech industries among the worst offenders.

Use the code ‘podcast’ to get 50% off tickets to the Australia Institute’s Revenue Summit. Discount available for Follow the Money listeners while stocks last.

Guest: Matt Grudnoff, Senior Economist, the Australia Institute // @mattgrudnoff

Host: Ebony Bennett, Deputy Director, the Australia Institute // @ebonybennett

Show notes:

New government data confirms gas exporters continue to pay no tax, the Australia Institute (October 2025)

Big gas is taking the piss, Follow the Money, the Australia Institute (April 2025)

Theme music: Pulse and Thrum; additional music by Blue Dot Sessions

The American Crisis — Same as It Ever Was

— —Trump’s plan no path to lasting peace

— Organisation: The Australia Institute —On this episode of After America, Antoun Issa joins Dr Emma Shortis to discuss the prospects for a deal that did not include Palestinians in the negotiating process. They also discuss the role of the United States in the Middle East, how power works in foreign policy, and opening up space for a bigger discussion about foreign policy here in Australia.

This episode was recorded on Friday 3 October.

Dead Centre: How political pragmatism is killing us by Richard Denniss is available now via Australia Institute Press.

Guest: Antoun Issa, Founder, DeepCut // @antounissa

Host: Emma Shortis, Director of International & Security Affairs, the Australia Institute // @emmashortis

Show notes:

Beyond the Two-State Solution: Policy responses to the Destruction of Palestine and the Insecurity of Israel, the Australia Institute (February 2025)

Australians overwhelmingly back sanctions on Israel, new poll finds by Alex McKinnon, DeepCut (October 2025)

Class Struggle

— Organisation: The Claremont Institute —Some years back during a conversation with Charles Murray about his justly praised book Coming Apart, Bill Kristol made perhaps the single most outrageous statement he has ever uttered in public. Murray’s book chronicled the decline in the traditional work ethic and other foundational values in the American lower classes, and Kristol suggested a solution. If the indigenous American lower classes are increasingly “decadent, lazy [and] spoiled,” Kristol said, “don’t you want to get new Americans in?”

The idea of replacing legacy Americans with immigrants is as distant from conservatism as one can get. The Americans described in Murray’s book are far more connected to American culture than any “new Americans” Kristol would like to see take their places. Given that, however, it is undeniable that there are significant problems with the white lower classes that need to be resolved.

Current ScholarshipThe Radical Potential of Consumer Financial Protection

— Organisation: Just Money —Preserving Majority Rule Requires Limiting the Senate Filibuster

— Organisation: The Claremont Institute —Last week, the federal government “shut down” because the Senate could not get the required 60 votes to invoke cloture and pass a continuing resolution to keep the government funded. The CR had passed the House, was supported by a majority of the Senate, and would have been signed into law by President Trump. It was defeated, however, by a minority of senators (mostly Democrats) who refused to fund the government unless the Republicans would make concessions on some other matters.

This raises an oft-debated question: Should the Senate further limit the use of the filibuster, which per Senate rules requires a supermajority of 60 votes to proceed to a vote on most legislative items? The Senate has already disallowed filibusters in the case of presidential nominations to executive or judicial office. However, some have suggested going even further and eliminating the filibuster altogether.

These calls to remove the filibuster have typically come from Democrats. They have made this argument when they’ve controlled the Senate and have been frustrated by Republicans using the filibuster to impede their agenda. They’ve noted how some Southern senators sought to thwart the enactment of federal civil rights legislation through the use of the filibuster. More generally, they have emphasized the non-democratic character of the filibuster, which empowers a minority in the Senate to defeat legislation supported by the chamber’s majority.

Chris Hedges: Can Love Persevere?

— —Dutch Treat: The Netherlands’ Exorbitant Privilege in the Eighteenth Century

— Organisation: Federal Reserve Bank of New York — Publication: Liberty Street Economics —Government’s FOI changes could cover up the next Robodebt – new research

— Organisation: The Australia Institute —The Royal Commission into Robodebt recommended making cabinet documents easier to access under FOI laws, finding the current system thwarted investigations into the scheme.

The Prime Minister himself described Robodebt as a “gross betrayal and human tragedy”, yet his government plans to make cabinet documents harder to access.

This is in direct defiance of the Robodebt Royal Commission’s recommendation to make cabinet documents available for public scrutiny.

“If cabinet documents had been public, the unlawful and cruel Robodebt scheme could have been exposed and prevented. For that reason, the Robodebt Royal Commission recommended making cabinet documents available under FOI,” said Bill Browne, Director of the Australia Institute’s Democracy & Accountability Program.

“The Albanese government wants to make documents even harder to access, in defiance of the Royal Commission, increasing the risk the next Robodebt will happen in secret.”

“The over-use of the cabinet document exemption and other problems with the FOI system are critical reasons why Robodebt was allowed to continue with impunity for so long,” said Maria O’Sullivan, Associate Professor at Deakin Law School.

“The proposed changes to the FOI Act will actually expand the cabinet exemption even further.”

The new research also reveals that it is government inefficiency, not the number of requests, behind the growing cost of the FOI system.

Teaching Applied Political Economy

— Publication: Progress in Political Economy —Political Economy is a broad church. This aspect makes it challenging to teach. One wants to engage all students in the classroom, but the range of students’ interests can vary considerably. Moreover, they demand more in terms of engagement and practicality. It is not enough to recite material for rote learning. How does one fulfill the demand while maintaining integrity of the unit in terms of breadth and depth of theory and method? Political Economy at the University of Sydney has an additional challenge in that students and staff approach facets of the economy – a system of social provisioning, more generally – from different disciplines. Disciplines represented by staff include economics, political science, sociology, and history, among others.

Yes, one can flip the units so that the examples provided to support theory act to stimulate thinking about possible explanations. Then, one can proceed to discuss the relevant theories to solidify students’ understanding. This is a good start for engagement, but beyond flipping what can one do?

A Country‑Specific View of Tariffs

— Organisation: Federal Reserve Bank of New York — Publication: Liberty Street Economics —

U.S. trade policy remains in flux. Nevertheless, important elements of the new policy regime are apparent in data through July. What stands out are the large differences in realized tariff rates by trading partner, ranging from less than 5 percent for Canada and Mexico to 15 percent for Japan and to 40 percent for China. This post shows that the bulk of cross-country differences in tariff rates is explained by two factors: the U.S.-Canada-Mexico free trade agreement and differing sales shares in tariff-exempt categories.

Refuting the Schmitt Smear

— Organisation: The Claremont Institute —At Wired, Laura Bullard writes that “Among the relatively few people associated with National Conservatism who do cite Schmitt openly in their own work are Thiel and Michael Anton, the essayist and sometime Trump administration official.”

We may leave to one side the extent to which I am “associated” with National Conservatism. I did not attend its last two conferences, having been invited and then disinvited in 2024 and not invited at all in 2025. I did sign its manifesto, an act I have come to regret for reasons Charles Kesler explains here.

But that is a quibble compared to the real whopper in the sentence quoted above. I have never, to the best of my knowledge—and I assume that I know my own oeuvre better than Bullard does—“cited” Carl Schmitt. A citation is a very specific thing: a quote or an idea attributed to an author that is typically accompanied by a footnote pointing to an exact source. Moreover, one may cite to signify approval or disapproval, or just to show that one is aware of the thing being cited. Bullard implies that my nonexistent citations of Schmitt signify approval. If she can show one instance of that in any of my writings, I promise to send her a set of steak knives. But I’m certain she can’t.

Starting Speakers’ Corners while we can

— —In Santa Fe, I have helped start a Speakers’ Corner project. We held our first session this past Saturday. Reprinted below, from the Indivisible Santa Fe website, is my diary. But first, click the image below for footage showing a sampling of speakers from the day.

How to Make Enough Good Men

— Organisation: The Claremont Institute —In his opening salvo, the esteemed Scott Yenor righteously scrutinizes the travesty of single-sex education at the Virginia Military Institute (VMI). Yenor lays bare the deleterious effects that forced sex integration has had on honor, cohesion, and the society into which graduates of the school march. What he emphasizes less, however, is how the Supreme Court’s decision in US v. Virginia fundamentally changed the nature of VMI’s military character, and the essential path to reclaiming same-sex spaces for military officer formation.

The most important part of Yenor’s essay is his proposal to create more VMIs that can force a legal and cultural reconsideration of issues involving sex in education and the military. This is a compelling recommendation, because responsibility lies with committed red state governors who have the authority to make bold moves to challenge existing institutions and create alternative ones.

The governor of West Virginia could establish a military academy with higher education credentials and, like VMI does today, endow a Reserve Officer Training Corps (ROTC) program at the school to serve as a pipeline into the military’s officer ranks. The character of this new service academy must be ironclad, inculcate a warrior ethos, and be set apart from the civil society that its graduates will pledge their lives to defend.

When Will the Lion Concern Himself

— —An image went mega-viral on multiple platforms last week, of a very young man with this text superimposed: “The lion does not concern himself with his noticeable memory loss, brain fog and slight cognitive decline.” The original Tiktok garnered 1.4 million likes over the course of the next several days, and a screenshot of the Tiktok reposted on X (formerly twitter) has so far been liked 287k times.

A sampling of comments:

“slight?”

“ok genuinely what is the cause of this why is it happening to everyone Help”

“what could this be? I have this and I’m 19-20”

“the brain fog’s so bad, the lion can’t even bring himself to care about anything”

You’re invited: Campaign Strategy Day 25th October

— Organisation: Free Palestine Melbourne —The Evolving Global Payments Landscape: Challenges and Opportunities for Australia and the Broader Asia-Pacific Region

— Organisation: Reserve Bank of Australia (RBA) —Free Speech Is a Core American Value

— Organisation: The Claremont Institute —Freedom of speech on university campuses has collapsed. Left-leaning college administrators, faculty, and students have been silencing conservative voices, and conservative students are increasingly adopting the Left’s errant ways. The Trump Administration has launched a strong counterattack that also seems poised to suppress speech.

The First Amendment’s free speech guarantees are at the core of our liberties. As Justice Louis Brandeis explained in Whitney v. California (1927), “If there be time to expose through discussion, the falsehoods and fallacies, to avert the evil by the processes of education, the remedy to be applied is more speech, not enforced silence.” Though set out in a concurring opinion, Justice Brandeis’s counter-speech doctrine has become the bedrock of free speech jurisprudence. In the milestone First Amendment case of United States v. Alvarez (2012), Justice Anthony Kennedy cited Justice Brandeis, opining, “The remedy for speech that is false is speech that is true. This is the ordinary course in a free society. The response to the unreasoned is the rational; to the uninformed, the enlightened; to the straight-out lie, the simple truth.”

The Man Who Kept the CIA Up at Night

— Organisation: The Claremont Institute —“Angelo.” With no surname necessary, the mere mention put Washington’s late-Cold War intelligence establishment on edge. Their tormenter was but a thirtysomething staffer on the Senate Select Committee on Intelligence. Contrarily, to the Cold Warriors sacrificing their all to defend the nation from Communist subversion and nuclear-missile threats, that single name, like a messenger from heaven, brought comfort and joy.

Angelo Codevilla knew and understood that the country that took him in as a boy would preserve itself and its Founding principles by having the most capable intelligence and counterintelligence services the world had ever seen. “Most capable” didn’t mean the largest, or the most lavishly funded, or supplied with the most high-tech gear. It meant having the most creative, most principled, most virtuous, and wisest people doing the job.

Angelo watched the United States’ intelligence apparatus deteriorate. Visiting CIA headquarters over the years, he passed the stone inscription that the late and great CIA director Allen Dulles placed as what he intended as a permanent greeting: “And ye shall know the truth and the truth shall set you free”—the Gospel According to John. In the last year of his life, Angelo saw the videos of CIA corridors festooned with mind-numbing murals and telescreens about diversity, equity, and inclusion. To Angelo Codevilla, who spoke Latin, DEI meant “of God.” A new god, a false one, possesses the American intelligence community today.

Governments keep making our housing crisis worse – and they’ve just done it again

— Organisation: The Australia Institute —Someone did, however, in that very same talkback segment. Phyllis rang in to say she did want to complain, because she wanted to retire and downsize, but property prices were growing so fast that she was worried about buying and selling in the same market – even if it was a smaller property.

Howard told her she was wrong.

“You’re not actually complaining. What you’re really saying is the value of a house hasn’t gone up enough,” he said.

Phyllis was having none of it: “No, no, no. I disagree. I think that it is ridiculous that the inflation of the housing prices … what about our grandchildren?”

Phyllis was right. Because while she complained, in late 2003, about people having to spend “$500,000 … on some broken-down old dump”, the median house price for her grandchildren – assuming they live in Queensland – is now $977,300.

The government knew house prices were a problem then, and it knows they are a problem now.

And just like Howard, who was told by the Productivity Commission in 2004 – in a briefing prepared for his cabinet – that an urgent review of his capital gains tax changes was needed to arrest the jumps in the housing market, every single government has only made short-term changes that ultimately make the situation worse, rather than get to the root cause. And they are STILL doing it.

In 2003 Howard blamed low interest rates for rising house prices, as people could afford to borrow more.

New government data confirms gas exporters continue to pay no tax

— Organisation: The Australia Institute —ATO data reveals:

- Santos Limited has racked up a 10th straight year of zero corporate tax payments from a total of nearly $47 billion in sales.

- Darwin’s Ichthys LNG Pty Ltd paid zero corporate tax for the 6th year running, from a total of $43 billion in sales.

- Petroleum Resource Rent Tax (PRRT) revenue has hit a 3-year low, down to $1.5 billion from a peak of $2.0 billion in 2021-22.

“The new tax data shows, yet again, that big gas is taking the piss out of Australians,” said Rod Campbell, Research Director at The Australia Institute.

“It beggars belief that a company like Santos can spend a decade selling almost $50 billion worth of gas and not pay a cent of tax on it.

“Japanese ambassadors and executives see fit to lecture Australia on energy and tax policy, while Japanese entities like Ichthys pay zero company tax and zero PRRT.

“PRRT revenue was lower in the latest year of data (2023-24) even though production and prices were high and a Labor government had been in power for over a year.

“Australia Institute research shows that over the 10 years to 2023-24, nurses paid $7 billion more in tax than did the oil and gas companies. How’s that fair?

The American Mind Podcast: The Roundtable Episode 287

— Organisation: The Claremont Institute —The American Mind’s ‘Editorial Roundtable’ podcast is a weekly conversation with Ryan Williams, Spencer Klavan, and Mike Sabo devoted to uncovering the ideas and principles that drive American political life. Stream here or download from your favorite podcast host.

Post-Kamala Clarity | The Roundtable Ep. 287

Market Rally Meets Resistance: Why October Could Get Dicey

— Organisation: Applied MMT —

Over the past six months, the S&P 500 has staged an incredible rally—one that was very much in line with what my models had projected earlier this year. Back at the start of 2025, following the tariff tantrum and the heavy selloff, we flagged the market’s move as a clear mispricing. Flows were simply too strong to justify the decline, and sure enough, the rebound has been powerful.

But as we head into October, the winds that fueled this rally are beginning to shift. What were tailwinds over the summer are now turning into headwinds. The key message I want to make clear is this: I believe we’re at an inflection point, and volatility is likely to spike in the near term. The rally looks exhausted, and a breather—possibly a sharp one—is overdue.

The First Domino: Treasury Flows and the Tax Drain

The most important factor right now comes down to fiscal flows. The daily Treasury statement is, in many ways, the first mover of macroeconomic outcomes.

Each September, we see a major corporate tax drain. This year, starting around September 11th, roughly $120 billion was pulled out of the private sector over a two-week period. On its own, that may not change the long-term trajectory of the economy—but in the short run, it significantly pressures the balance sheet capacity of the financial sector.

The housing market just got more cooked

— Organisation: The Australia Institute —On this episode of Dollars & Sense, Greg and Elinor discuss whether Emirati supermarket chain Lulu will take on Colesworth, the Reserve Bank’s decision to keep rates on hold, Trump’s unworkable tariffs on foreign films, and how the government could actually address the housing crisis.

Use the code ‘podcast’ to get 50% off tickets to the Australia Institute’s Revenue Summit. Featuring Hon Steven Miles MP, Senator Larissa Waters, Senator David Pocock, Dr Kate Chaney MP, Greg Jericho and more, the Summit is on Wednesday 29 October at Parliament House in Canberra. Discount available for Dollars & Sense listeners while stocks last.

Dead Centre: How political pragmatism is killing us by Richard Denniss is available now via the Australia Institute website.

This discussion was recorded on Thursday 2 October 2025.

Host: Greg Jericho, Chief Economist, the Australia Institute // @grogsgamut

Host: Elinor Johnston-Leek, Senior Content Producer, the Australia Institute // @elinorjohnstonleek

Show notes:

Krystal Kyle & Friends | Chris Hedges on American Fascism

— —Restoring Single-Sex Education at VMI and Beyond

— Organisation: The Claremont Institute —Sex-specific education is needed to preserve America’s self-governing republic. Though many are only now rediscovering single-sex public schooling, there is still space for it to exist within the framework established by the Supreme Court’s 1996 United States v. Virginia decision, as I argue in a just-released Provocation for the Claremont Institute’s Center for the American Way of Life. In that decision, Justice Ruth Bader Ginsburg ruled for the 7-1 majority that the Virginia Military Institute (VMI), a public school, must admit women.

The Bush Administration sued VMI in the early 1990s, alleging that Virginia’s single-sex military school violated the 14th Amendment’s Equal Protection Clause. The Clinton Administration continued the case, and Virginia had to tailor its defense to the reigning civil rights framework. Since VMI’s discriminatory practices faced “intermediate scrutiny” from the courts, Virginia had to prove that its admissions policies supported practices that served important but gender-neutral educational goals.

Virginia asserted that men especially benefit from and are attracted to VMI’s distinctives, including its Marine-style, in-your-face “adversative” training methods, its lack of privacy, its egalitarian grooming and uniform standards, and its rigorous, stoical honor code.